The Insurance Post

I’ll have to preface this post by saying that I’m no fan of insurance companies. So, if you’re looking for the ‘best travel insurance’, then you aren’t going to find it here. This is not a ‘how to insure yourself’ post. But, if you want to skimp on the minimum and cheapest way forward, then I’m your guy*.

Cavalier attitude? Maybe. Consider the source before reading on…

Travel Insurance:

We don’t have it. Next…

Actually, we did consider it before leaving and just didn’t find anything that justified the expense. For the most part – as I understand it – this insurance aims to get you back home, where you will no longer be covered by travel insurance. I’m sure some company has a policy that’s good for somebody… but we passed.

Health Insurance:

From Mexico on down, we have been covered for nothing. This is a risk we have been perfectly willing to take. Over the past 3 years, doctor and hospital costs for our entire family have added up to about $100 USD. And, in most countries, a pharmacist can sell you most drugs without a prescription, at a fraction of U.S prices.

If you can get some quotes for family medical insurance that covers international travel for under $100 USD for three years, then please get back to us. Otherwise, we’ll just carry a wallet.

Auto Insurance:

We’ve only purchased insurance in countries where it is required by law – i.e. Mexico, Nicaragua, Colombia. There might be a few others, and we indicate it in other posts (the Archives section links to the border crossings with info for that country). And, we typically only bought the insurance once we got there (except Mexico, we used www.BajaBound.com before leaving – I think we paid $110 for a 6 month policy.) In Nicaragua, for example, a month-long policy purchased at the border is only about $12 USD.

Regardless of whether or not auto insurance is required in any country – if there is corruption – insurance documents are a common tool the corrupt officials will use to try to get bribe from you. If you are a foreigner driving an ‘expensive’ vehicle like an old VW – they may insist you produce insurance documents or pay a big fine. So, keeping an insurance document of some kind is a good idea – even if it’s your old expired one from back home.

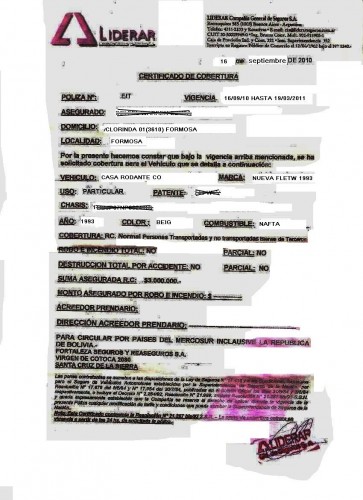

When we were in Peru, we met another couple from the U.S. that had been traveling for a few years in a 70’s-era motor home. Obviously, they had big bucks. At one particular border crossing in Argentina, they ran into a scam and were ultimately forced to buy ‘insurance’ right at the border post. They paid good money for the terribly forged document you see in the actual scanned image below (altered to protect their identity). After they realized the document was so bad it wouldn’t convince any local cop they had actually paid for it, they generated a new fake document based on the original forgery. They gave it to us and told us it was their goal to make this the most popular fake insurance form for overlanders out there. We’ve since learned that some overlanders call this ‘self-insured.’ We never got around to posting their document… so, fill in your own info and… here you go. It works. You’ll just have to trust us.

Of course, we would never suggest that anyone use fake documents. If you are trying to avoid a corrupt official, then proceed at your own risk. Never attempt it when a real accident or injury is involved.

In general, Latin American countries are ‘at fault’ states. If you get in a wreck – it’s your fault. Insurance – even if legit – is not a “get out of jail free” card. There are horror stories out there – of someone’s life’s savings being drained to pay lawyers and families to make the accident ‘go away’ – but we’ve also found that people just love to tell horror stories. You’re a grown-up: you figure it out.

* This is not advice. Do your own research.

Wait a minute, no health insurance at all?! Did you not keep your previous insurance from the U.S. (which would probably cover you at least in part while traveling)?

I would be concerned mainly about emergency care. Didn’t you have to go the ER at one point? Are costs just that much lower down there that it would always be worth it to pay out of pocket?

I’d probably take the opposite, total-pansy route of getting more insurance for possible emergencies and even the potential need for getting prescriptions written from a U.S. doc for a foreign pharmacy. (Had to do that once or twice in Europe.)

You people are brave.

Signed, a hypochondriac.

Hey guys, glad to see you are back south! We are back home in Portland, but have good memories of our trip.

For health insurance, we had a cheap catastrophic/high deductable plan from the USA to keep our proof of coverage/solvency in case something really bad happened. In the developing world, just like you, we paid out of pocket, because health care is cheap and that’s what the locals do. If only the US was this way!

For auto insurance, the only luck we had for a foreign plated vehicle in South America (Mexican plates no less) was Sanborns insurance out of Brownsville, TX. They will sell you a policy good for just about all of South America and it isn’t all that much for liability only. You will be legal that way, and it is reassuring that you have it while you drive aggressively in BsAs city traffic :-). You can buy it using email and a few faxes.

Pingback: BodesWell » Crossing the Equator and a Border.